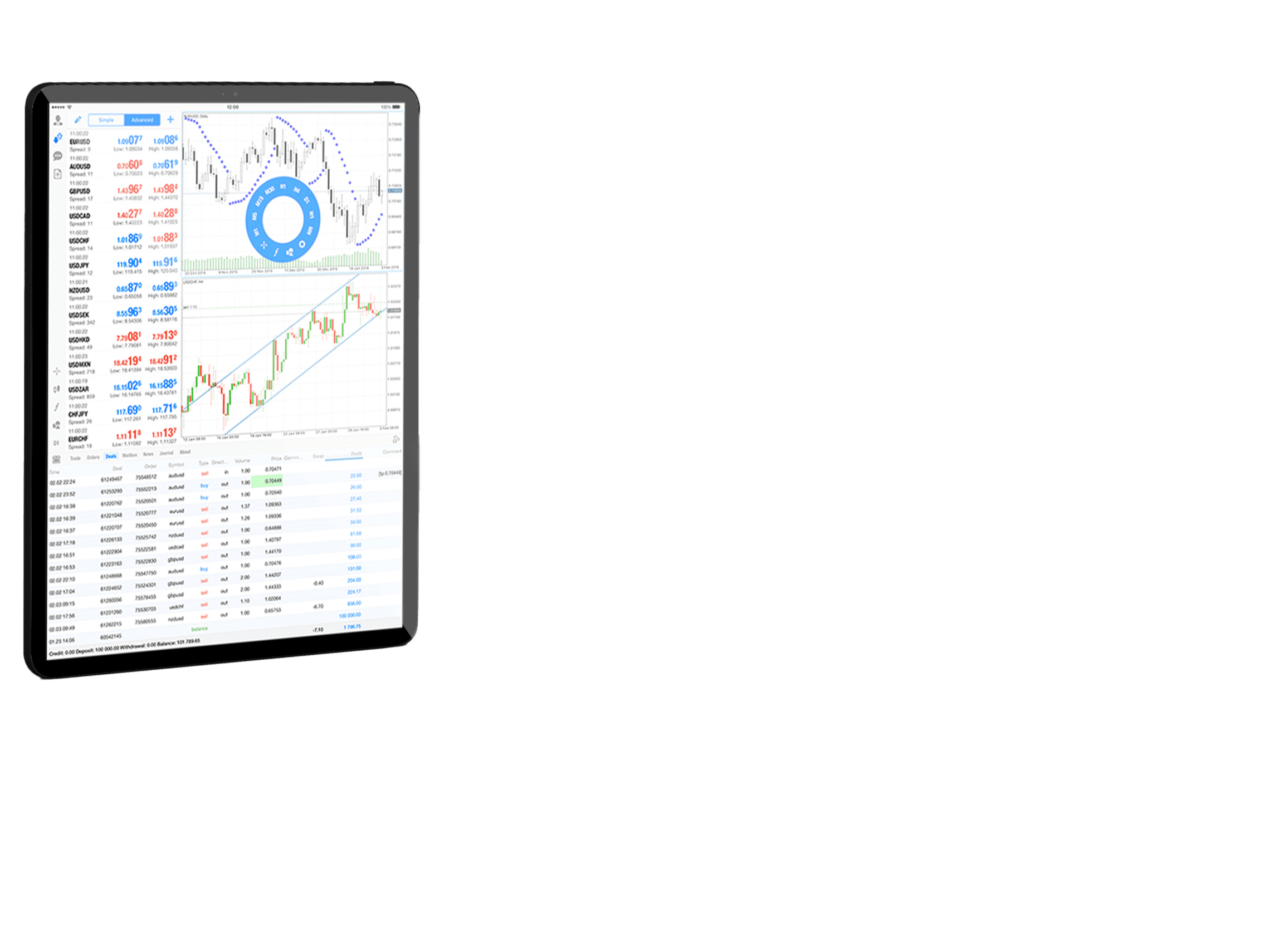

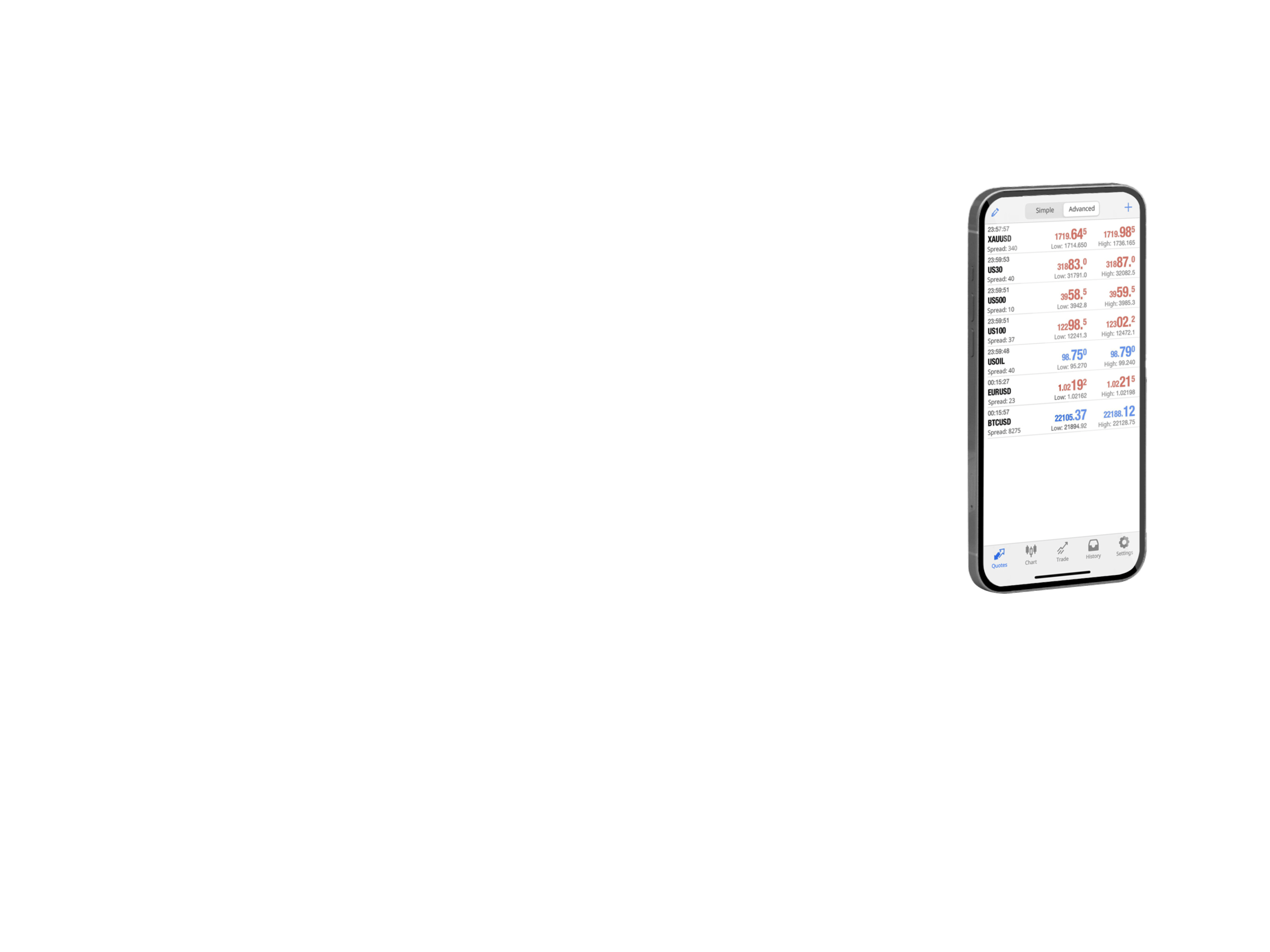

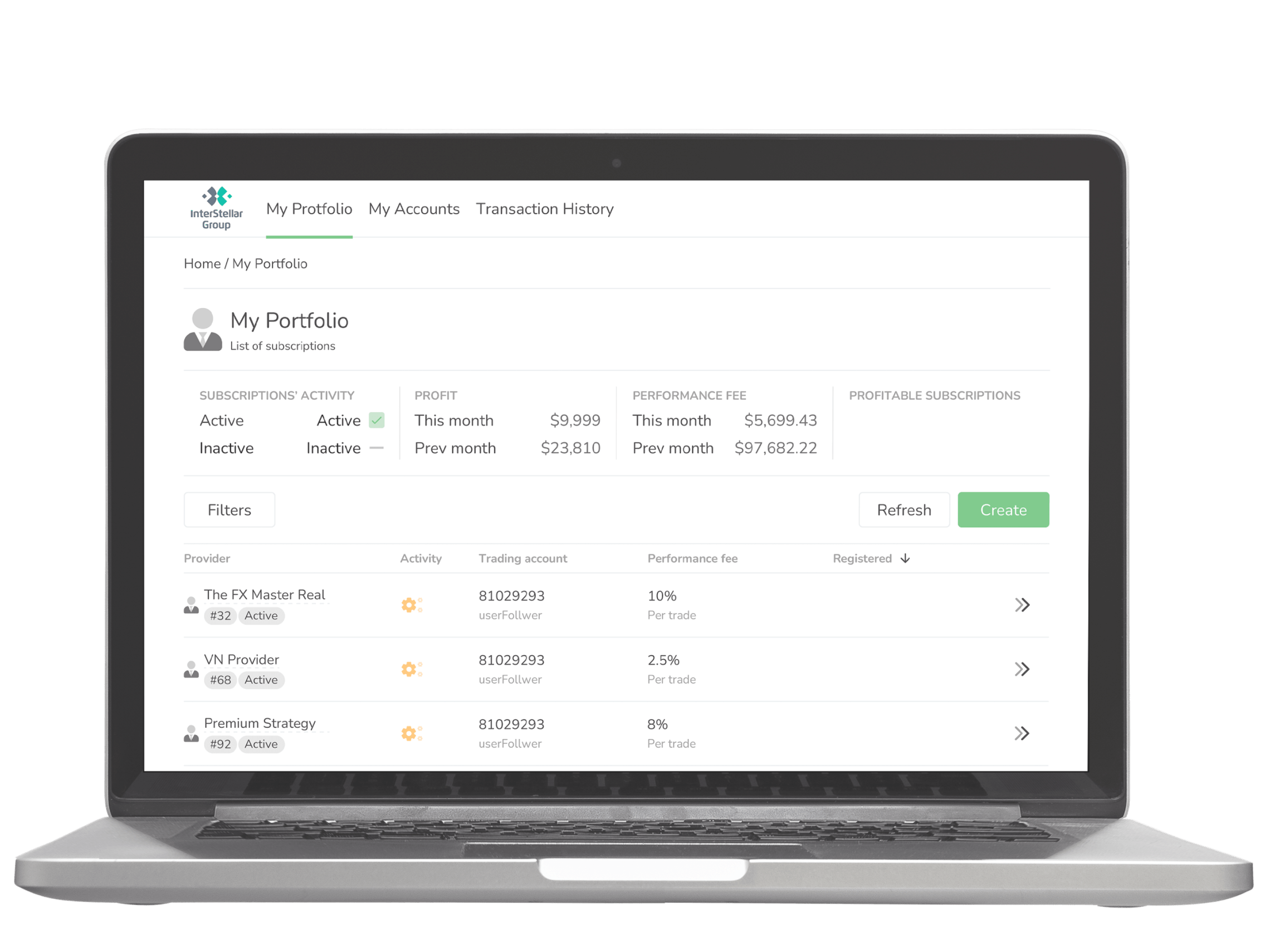

InterStellar Copy Trading

trade SMARTER

copy experts’ strategy

PROMPT

deposit / withdrawal

one-click, instant arrival via multi method

Points Mall

while you’re trading

get MORE

ถอนไว เงินเข้า ทันทีแค่ 2 นาที

ทุกวันตลอด 24 ชั่วโมง หมดปัญหาการรอคอย

Perfect Your Strategies,

Out-trade the Competition

Register & Win BIG

策略领航 星际征程

加入征程

謀策御市.傲視星際

大展身手

พัฒนากลยุทธ์ของคุณให้ถึงที่สุด

เอาชนะคู่แข่งในการแข่งขัน

ลงทะเบียนแข่งขันและชิงรางวัล ใหญ่

Hoàn thiện chiến lược của bạn,

Vượt trội so với đối thủ

Đăng ký & thắng LỚN

Совершенствуйте свои стратегии,

Опередите конкурентов

Зарегистрируйтесь и получите большой Выигрыш

Trade For Prizes 2024

-

Forex

Symbols Spread Bid Price Ask PriceEURUSD remove 1 1.07266 1.07267GBPUSD remove 5 1.25081 1.25086USDCAD remove 4 1.36675 1.36679USDCHF remove 2 0.91236 0.91238USDJPY remove 2 155.578 155.58

Forex

Symbols Spread Bid Price Ask PriceEURUSD remove 1 1.07266 1.07267GBPUSD remove 5 1.25081 1.25086USDCAD remove 4 1.36675 1.36679USDCHF remove 2 0.91236 0.91238USDJPY remove 2 155.578 155.58 -

Metals

Symbols Spread Bid Price Ask PriceXAUUSD remove 6 2333.06 2333.12XAGUSD remove 8 27.351 27.359XPTUSD remove 174 1070.63 1072.37

Metals

Symbols Spread Bid Price Ask PriceXAUUSD remove 6 2333.06 2333.12XAGUSD remove 8 27.351 27.359XPTUSD remove 174 1070.63 1072.37 -

Energies

Symbols Spread Bid Price Ask PriceXNGUSD remove 130 2.498 2.511XTIUSD remove 13 83.542 83.555XBRUSD remove 13 88.315 88.328

Energies

Symbols Spread Bid Price Ask PriceXNGUSD remove 130 2.498 2.511XTIUSD remove 13 83.542 83.555XBRUSD remove 13 88.315 88.328 -

Indices

Symbols Spread Bid Price Ask PriceAUS200 remove 40 7572.1 7576.1EU50 remove 25 4963.5 4966FRA40 remove 22 8029.7 8031.9HK50 remove 115 17308.8 17320.3SPA35 remove 181 10994.7 11012.8

Indices

Symbols Spread Bid Price Ask PriceAUS200 remove 40 7572.1 7576.1EU50 remove 25 4963.5 4966FRA40 remove 22 8029.7 8031.9HK50 remove 115 17308.8 17320.3SPA35 remove 181 10994.7 11012.8

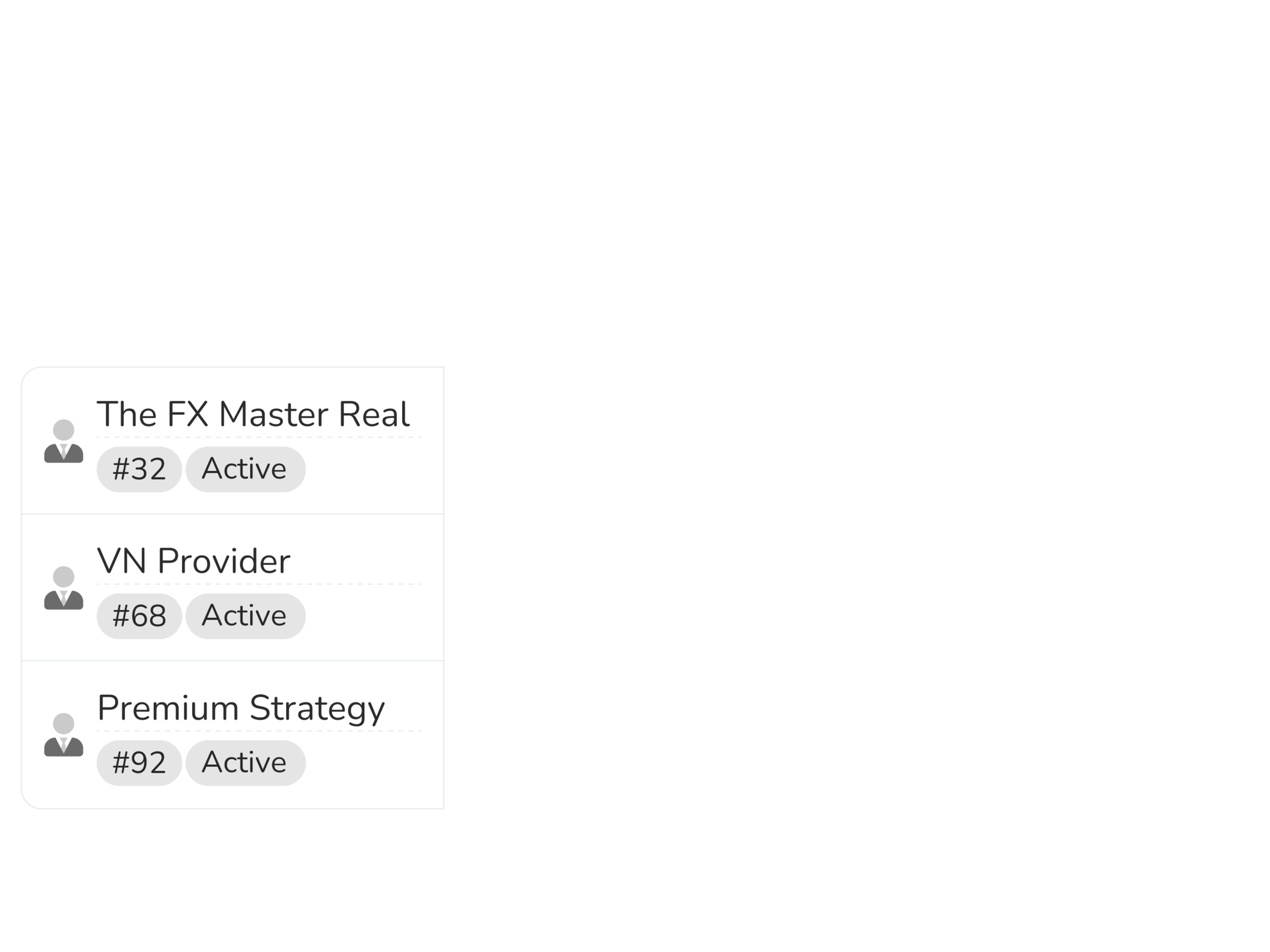

Follow to profit.

WITH INTERSTELLAR GROUP

Announcement: Interstellar Brand Upgrade

Interstellar is proud to announce a complete brand upgrade, with the establishment of InterStellar Group as our new brand name. As part of this upgrade, we have also launched a brand new logo and website, with the domain name www.fisg.com。

Clients can now access our website directly by searching for fisg.com, or by using our old website address, which will automatically redirect to our new website. This new website provides a more user-friendly experience, with improved functionality and navigation.

At InterStellar, we are committed to providing our clients with the highest level of professional and quality service. As part of our brand upgrade, we will continue to develop our business and strengthen our services to provide even more specialized and personalized support.

We would like to express our gratitude for the understanding and support of our clients throughout this upgrade process. We are confident that this brand upgrade will enable us to better serve our clients and meet their evolving needs.

Thank you for your continued support and trust in InterStellar.

InterStellar Group

Announcement: Interstellar Brand Upgrade

Interstellar is proud to announce a complete brand upgrade, with the establishment of InterStellar Group as our new brand name. As part of this upgrade, we have also launched a brand new logo and website, with the domain name www.fisg.com。

Clients can now access our website directly by searching for fisg.com, or by using our old website address, which will automatically redirect to our new website. This new website provides a more user-friendly experience, with improved functionality and navigation.

At InterStellar, we are committed to providing our clients with the highest level of professional and quality service. As part of our brand upgrade, we will continue to develop our business and strengthen our services to provide even more specialized and personalized support.

We would like to express our gratitude for the understanding and support of our clients throughout this upgrade process. We are confident that this brand upgrade will enable us to better serve our clients and meet their evolving needs.

Thank you for your continued support and trust in InterStellar.

InterStellar Group