- Company

- Trading

-

-

-

Online Campaigns

Online Campaigns - InterStellar Group Simulated Trading Contest

-

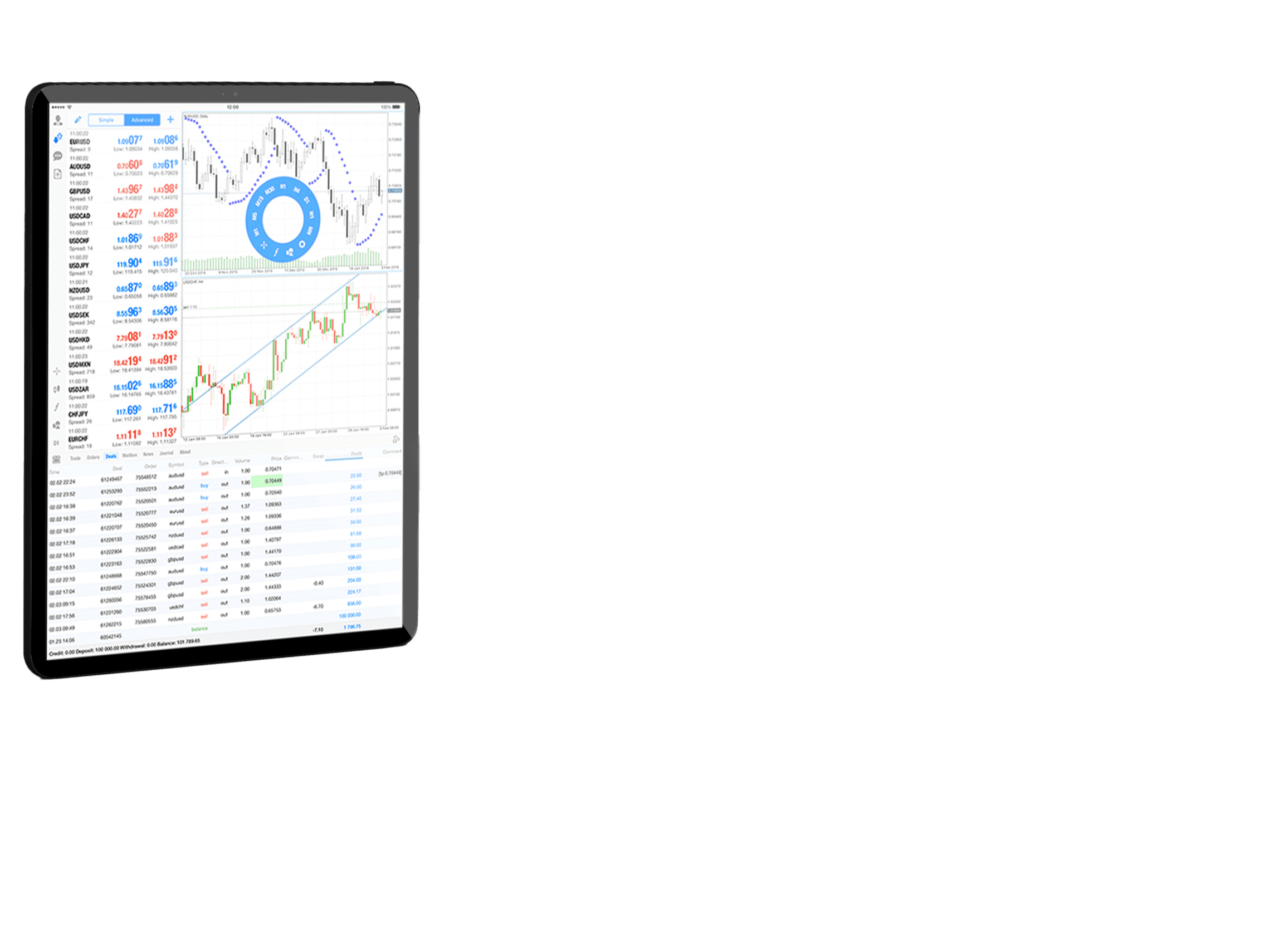

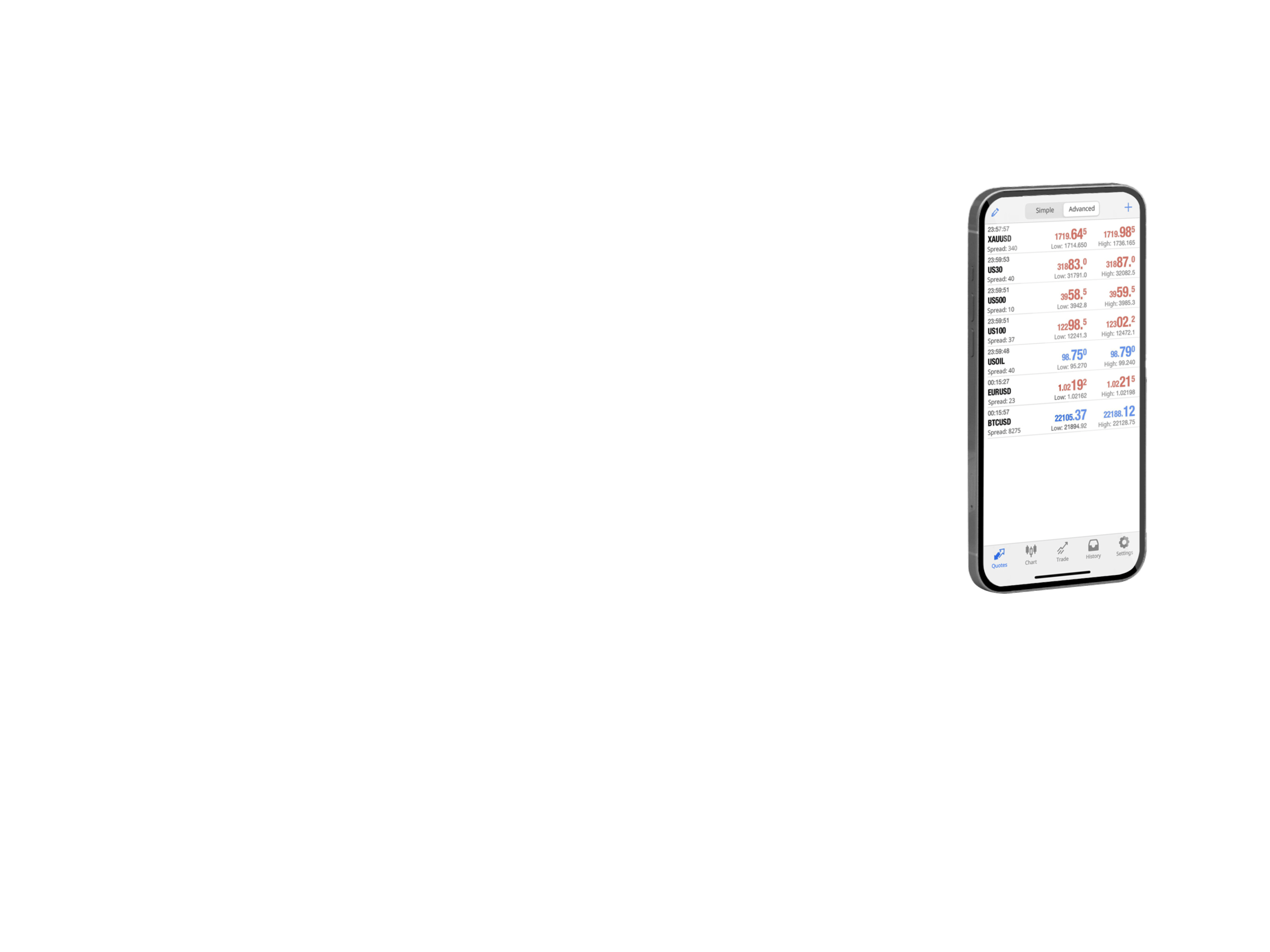

Trading Platform

Trading Platform - MT4

- MT5

- MetaTrader Webterminal

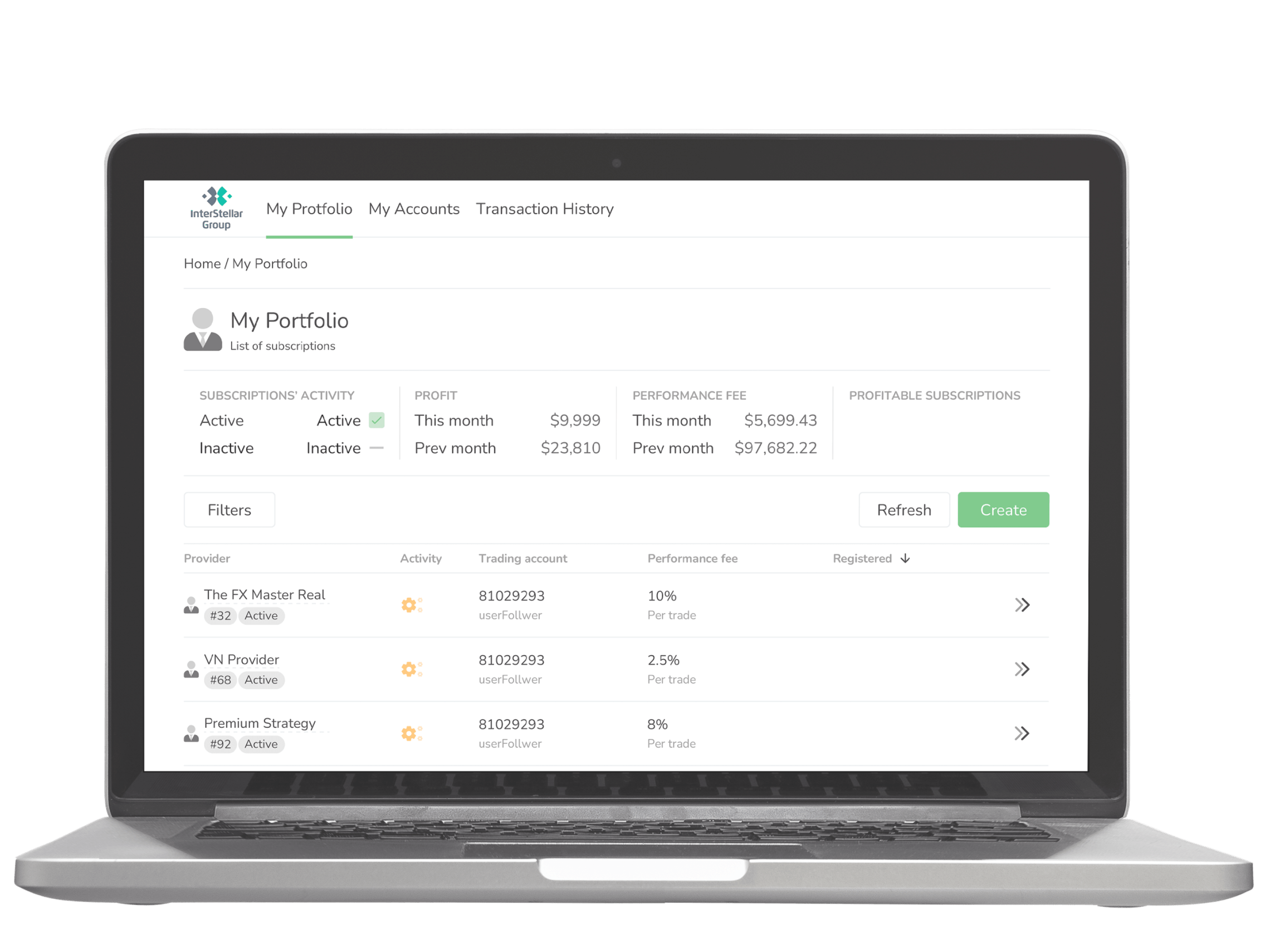

- Copy Trade

-

-

-

Trading Products

Trading Products - Forex

- Metal

- Energy

- Index

-

Account

Account - Types of Accounts

- Deposit and Withdrawal

-

Trading Tools

Trading Tools - MAM

- PAMM

- MultiTerminal

- Forex Calculator

-

-

-

- Education

- Markets

- Partners

-

-

-

Partners

Partners - Partners

-

-

-

English

-

Forex

Symbols Spread Bid Price Ask PriceEURUSD remove 1 1.08528 1.08529GBPUSD remove 1 1.2867 1.28671USDCAD remove 4 1.38165 1.38169USDCHF remove 6 0.88306 0.88312USDJPY remove 6 154.221 154.227

Forex

Symbols Spread Bid Price Ask PriceEURUSD remove 1 1.08528 1.08529GBPUSD remove 1 1.2867 1.28671USDCAD remove 4 1.38165 1.38169USDCHF remove 6 0.88306 0.88312USDJPY remove 6 154.221 154.227 -

Metals

Symbols Spread Bid Price Ask PriceXAUUSD remove 6 2373.58 2373.64XAGUSD remove 8 27.775 27.783XPTUSD remove 174 1070.63 1072.37

Metals

Symbols Spread Bid Price Ask PriceXAUUSD remove 6 2373.58 2373.64XAGUSD remove 8 27.775 27.783XPTUSD remove 174 1070.63 1072.37 -

Energies

Symbols Spread Bid Price Ask PriceXNGUSD remove 130 2.498 2.511XTIUSD remove 18 78.632 78.65XBRUSD remove 18 82.031 82.049

Energies

Symbols Spread Bid Price Ask PriceXNGUSD remove 130 2.498 2.511XTIUSD remove 18 78.632 78.65XBRUSD remove 18 82.031 82.049 -

Indices

Symbols Spread Bid Price Ask PriceAUS200 remove 40 7929.6 7933.6EU50 remove 25 4846.3 4848.8FRA40 remove 22 7486.2 7488.4HK50 remove 115 17011.5 17023SPA35 remove 52 11102.1 11107.3

Indices

Symbols Spread Bid Price Ask PriceAUS200 remove 40 7929.6 7933.6EU50 remove 25 4846.3 4848.8FRA40 remove 22 7486.2 7488.4HK50 remove 115 17011.5 17023SPA35 remove 52 11102.1 11107.3

START IT

SIMPLY

MetaTrader

MT4 & MT5

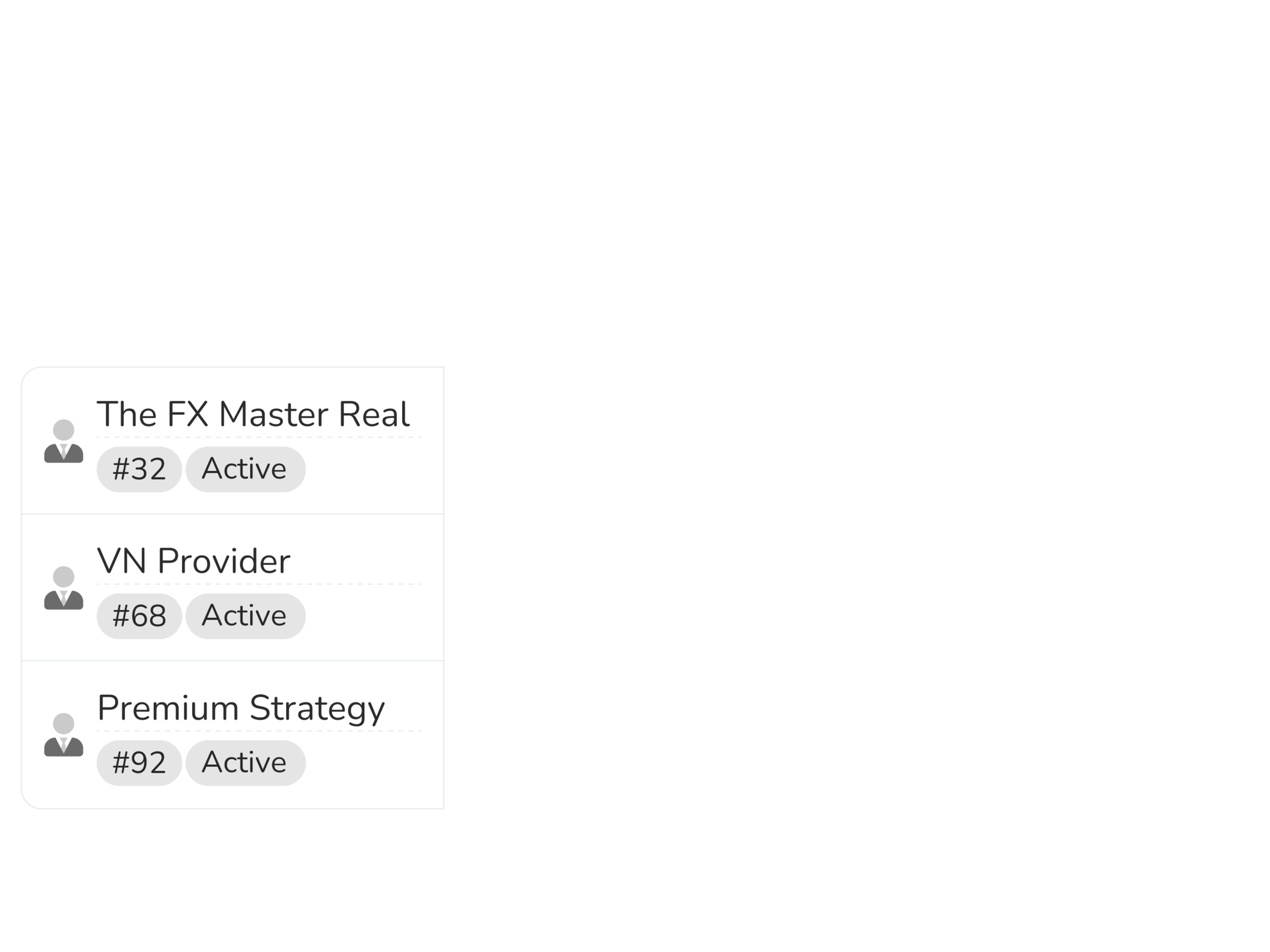

COPY TRADING

With InterStellar Group

COPY TRADING

With InterStellar Group

Registration/ Signal/ Follower

Growing

14%

Trade setups done for you.

Follow to profit.

Follow to profit.

ENHANCE

YOUR TRADING EXPERIENCE

WITH INTERSTELLAR GROUP

WITH INTERSTELLAR GROUP

Professional Service

24/5 multiple language service

More

than Trading